Financial

Government Bank Deposits in Yogyakarta Surge

Government deposits in Yogyakarta commercial banks soared sharply in three years. LPS recommends moving budgets into active spending to stimulate the local economy.

Data Privacy: More than Compliance — A Cornerstone for Fintech Sustainability

From compliance to competitive edge: how data privacy drives sustainable growth in Indonesia’s finance sector

Strong Q3 2025: Bank Syariah Indonesia Records Financing Worth IDR 300 Trillion

Driven by gold business and consumer finance, Bank Syariah Indonesia posts robust double-digit growth above the industry.

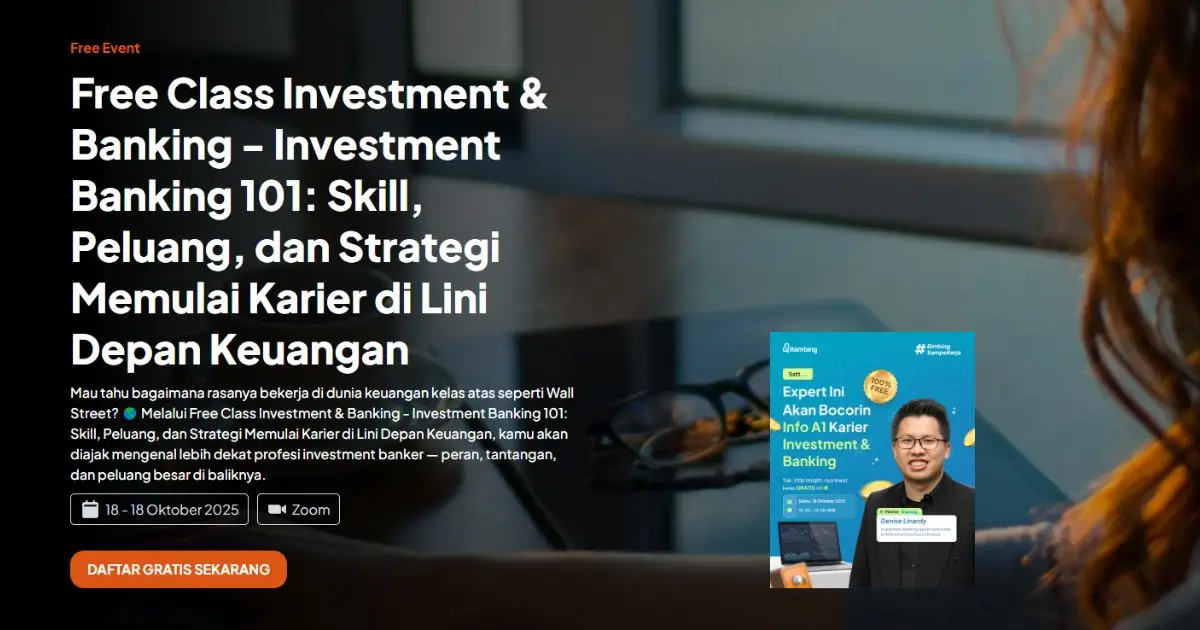

Want to Learn Investment Banking from Scratch? Join the Free “Investment Banking 101” Class by Dibimbing!

Dibimbing.id is offering a free online class, “Investment Banking 101”, on October 18, 2025. This beginner-friendly session introduces participants to the fundamentals of investment banking, led by industry expert Denise Linardy. Participants will gain valuable insights, practical knowledge, and a digital certificate to strengthen their professional profile.

OVO Finansial Says Fintech Lending Profits Could Exceed 2024 by 2025

OVO Finansial projects fintech lending profits in 2025 could surpass 2024’s Rp 1.65 trillion, with industry profits already at Rp 1.34 trillion by July. Backed by 22% growth, OVO leverages AI, risk management, and data-driven strategies to expand digital lending through Grab’s ecosystem, supporting MSMEs and national economic growth.

Regarding the revision of the State Finance Law, Finance Minister Purbaya said there has been no discussion yet.

Finance Minister Purbaya Yudhi Sadewa confirmed that the government has not yet held any discussions on revising the State Finance Law, despite the bill being listed as a priority in the 2025 legislative program. He emphasized that existing budget limits will be maximized for optimal economic impact.

Indonesia Affirms Financial Commitment to Palestine Amid UNRWA Funding Crisis

Indonesia pledges ongoing financial support to UNRWA, despite funding shortfalls, reaffirming its commitment to humanitarian solidarity with Palestine.

The Yogyakarta Regional People’s Representative Council (DPRD) responded to the protests demanding that COVID-19-affected MSMEs’ debts be written off.

The Yogyakarta DPRD acknowledged that many MSMEs struggled with unpaid debts after COVID-19. Chair Nuryadi pledged to forward relief demands to the central government while admitting DPRD’s limited authority. Protesters urged debt write-offs and condemned aggressive bank seizures. They argued that defaults stemmed from pandemic impact, not moral failure.